The Generation of Loans

The cost of college makes students across the country take out massive amounts of loans. President Biden recently enacted a plan to tackle student debt during the pandemic.

Recently, President Joe Biden signed in the ‘Student Loan Forgiveness Plan’ (CCO)

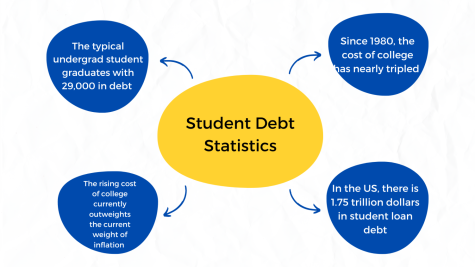

Kids are often told to ‘reach for the stars’, but as people get older they soon realize that there are limitations to dreaming big. With the average debt amount being $29,000 for a typical undergrad student. The main limitation is the staggering prices of college. Since 1980, the total cost of a public and private college education has nearly tripled. Currently, it is still on the rise.

Grant Eggleston, senior, is currently looking into film schools to strengthen his skills for his potential future career.

“I have looked into two schools so far… I am currently looking for schools that provide a good film program as I would like to build my skills as a storyteller or writer, and as a producer or a director,” says Eggleston.

In planning ahead, Eggleston has become personally involved with the concept of student debt.

“The concept or idea of being in debt in such an environment strikes me as a stressful and even scary thought, but I personally feel that I have a good plan that will ensure that I pass through my college years without going too far into debt,” states Eggleston.

By doing this Eggleston has thought of going into the Air Force, however that isn’t an option for a lot of kids. According to a recent survey from Junior Achievement USA, many seniors and graduates don’t have a plan that will guarantee them a manageable amount of debt. In fact, 54% of teens feel unprepared to finance their futures.

iJAG (Iowa Jobs for America’s Graduates) specialist Brooklyn McClinton helps connect students with jobs and leadership opportunities. She also helps students beyond high school.

As a recent, college graduate herself, McClinton has experience with student debt. After financial aid and doing apprenticeships throughout college, she still has the burden of paying loans.

“Even with my apprenticeships, I’m still $15,000 in debt,” says McClinton.

As students apply to college and make their decisions, some have to face the question of whether or not furthering their education would be worth it. According to a survey conducted by CNBC, 54% of students with federal loans say debt wasn’t worth it. Some students are even hesitant to consider college because of the impending costs.

“…[with] the kids I work with right now; college really isn’t their first choice, and cost is a big factor behind that,” commented McClinton.

President Biden recently announced a plan to tackle the burden of student debt for $43 million past and current students. The main part of it is to target debt relief: The Department of Education will provide up to $10,000 debt cancellations to individuals who make less than $125,000 a year, and $20,000 to recipients of the Pell Grant.

The GOP (Republican Party) response has been negative. This will cost each taxpayer about $2,000, according to the National Taxpayers Union Foundation. With the current rates of inflation, many Republicans think that this isn’t going to turn out well.

Notorious Republican representative, Marjorie Taylor Greene had a lot to say about Biden’s plan.

“Taxpayers all over the country…they shouldn’t have to pay off the great, big, student loan debt for some college student that piled up massive debt going to some Ivy League school,” commented Greene on a talk show.

It doesn’t sound fair for a person who decided not to go to college to pay off someone’s student debt; it definitely doesn’t sound fair for someone else who already paid their loans to pay off some of the debt. However, our taxes have always been helping people who aren’t in the same position as us. For example, farmers and veterans. This is not a new concept.

Although this plan might provide some hope for future college students, this plan was only circumstantial. Using the Higher Education Relief Act established by President Bush, which allows the Secretary of Education to change student financial assistant programs at a time of war, a military operation, or a national emergency. In this case, Biden used the COVID-19 pandemic for his reasoning.

Even though this is just for this year, this is a huge step towards debt forgiveness. The thing that both parties can agree on is that student debt is a huge problem that needs some type of solution. It’s just a matter of how we solve it.

Megan is a senior at Liberty. This is her third year on staff and she is the editor-in-chief for the 2023-2024 school year. She is involved in theatre,...