The Affects COVID-19 has had on Local Businesses

The Live Wire explores how COVID-19 has had affects on small businesses.

Stores in Coralville, Iowa.

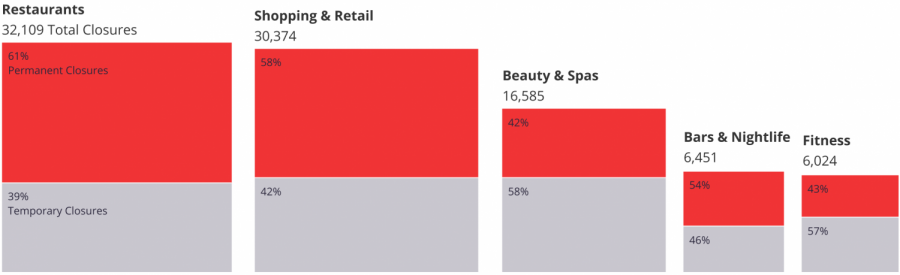

This last year, COVID-19 has had a huge impact on many things. One of the biggest impacts being on our economy and businesses all over America, small businesses in particular. At the beginning of the pandemic, Yelp.com’s Local Economic Report reported that 140,104 businesses were marked temporarily closed. By August, that number fell to 65,769 which doesn’t necessarily mean those businesses reopened. By the end of September 2020, 97,966 (60%) businesses were closed permanently.

“If economic trends continue at this rate, one in five business owners anticipates they won’t make it until the end of the year [2020],” said Kevin Kuhlman, the vice president of federal government relations for the National Federation of Independent Business (NFIB).

Within those businesses, restaurants, retail, beauty businesses, and fitness centers such as gyms have suffered the most. Kim and Cory Nelson are the owners and trainers of Next Level Extreme Fitness (NLXF), a gym here in North Liberty. They have weathered the multiple shutdowns of gyms in Iowa, and Kim put in perspective how difficult it was to keep their gym open during this time.

“The most difficult thing for us in the pandemic so far has been the ever changing rules and regulations. However, it has taught us that we can adapt quickly and adjust to anything thrown our way,” said Kim. “When we were first shut down in March, we provided our members with free at home live workouts to keep them moving. When we realized we were going to have to be shut down longer than anticipated, we started to rent out our equipment. When we were able to open back up in May, once we got things up and running again we started a virtual membership option. This has been a nice option available not only for people who do not want to come because of Covid, but also former clients who have moved away. “

Nick Tallman, the owner of Alphagraphics in North Liberty, also described the effect the pandemic has had on his business.

“The biggest challenge for us has been adapting to our customers’ needs, whether that is changes to delivery procedures, in-shop precautions, or simply understanding their needs in a crazy time. The most difficult aspect has been seeing businesses struggle to keep their doors open. We pride ourselves on helping small to medium businesses with all of their marketing needs and many are unable to market themselves financially during the pandemic. Our biggest concern is the next 6-12 months. How soon will we return to normal? Will we ever return to normal? Will any of our customers need to close shop? We just don’t know. We are always looking for the next product to help our customers succeed and grow,” said Tallman.

Since there is such a large amount of business owners and people struggling financially, there have been many politicians in Washington who have voiced their support when it comes to sending out a third round of stimulus checks. Due to the two Democratic Senate representative victories in Georgia, there’s now an even amount of Democrats and Republicans in the Senate. With Vice President Kamala Harris as the tie breaking vote, this makes it easier for President Joe Biden to pass another round of stimulus. Since Biden has said he supports another round of stimulus checks, analysts are anticipating that more COVID relief is on the way.

“We expect growing anticipation that Democrats will pursue additional stimulus, with a $2,000 check (or at least the remaining $1,400) as a leading item,” Ed Mills, an analyst with investment bank Raymond James, said following the Georgia election.

A third round of stimulus is predicted to be passed in March because the most recent relief measure extended unemployment programs until mid-March. This puts pressure on Congress to give jobless benefits and additional financial assistance by that cutoff. A third round of stimulus could be controversial though with most economists viewing other relief programs as more effective, such as said unemployment benefits. This is because the stimulus checks are distributed to almost every middle and low income household, whether they’re struggling because of the pandemic or not. Terra Hartley, owner of Gaia hair salon in Coralville, Iowa, gave her opinion as a business owner on the effectiveness of stimulus checks.

“I personally think that unemployment benefits would be better because it would be a continued help with income instead of getting a check in the mail (being unsure of the amount or when it might arrive) and not knowing if another is coming I was very grateful to get my stimulus check but it was hard to make that money stretch as a business owner and mother who was out of work for two months,” explained Hartley. “With unemployment they can save the stimulus money that is going to people who still have their full time jobs, or aren’t feeling financial stress during this time, and instead help small business and families who are feeling the financial stress during this time. Since we don’t know how long we will be making less money or if there will be another shut down, it would be nice to have some financial assistance that is consistent.”

Laney Prelle, sophomore, is a second year staff member for the Live Wire.. At Liberty, she is involved in journalism and plays basketball. She spends most...